ブログ

Consumer Survey to Prove Acquired Distinctiveness for Color Marks [ Japan Trademark & Design Update]

2022.11.25

Introduction

In recent times, an increasing number of trademark applications have been submitted together with customer surveys as evidence to prove the acquired distinctiveness of the mark in question, not only in court cases but also in matters before the Japan Patent Office (“JPO”). However, a high level of recognition in such surveys does not necessarily mean that the evidence is considered to be highly probative, and there is still no established practice in this field. In this article, we would like to introduce some recent decisions and judgments on color marks in which consumer surveys were submitted and consider how the submitted consumer questionnaires were evaluated.

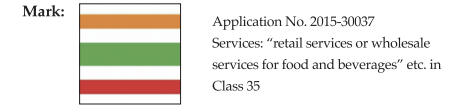

Seven Eleven’s stripe color mark

The first case involves Seven Eleven’s corporate color mark shown below. Seven Eleven filed a trademark application for a combination color mark designating retail services or wholesale services for food and beverages in Class 35 on April 1, 2015, the very first day on which the color mark system was introduced in Japan. This application received a Provisional Refusal due to lack of distinctiveness during the examination process and Seven Eleven therefore submitted a consumer survey to strengthen its argument that the mark had obtained acquired distinctiveness. As a result, the mark was successfully registered in the examination stage.

The survey was conducted nationwide, excluding Okinawa, among 500 men and women aged 20 to 60 who shop at convenience stores. Respondents were presented with a rectangular drawing of the applied-for trademark, similar to an actual store sign, and asked for the name of the retail store. As a result, 90.6% of the respondents answered the name “Seven Eleven”. In addition to this, to increase the credibility of the questionnaire, the same question was asked to another 500 respondents by presenting a drawing of the same rectangle with a “different color.” In this case, only 1.8% of them answered the name “Seven Eleven”. Through this result, the JPO judged that 88.8% of the consumers recognized that the color combination of orange, green, and red functioned as a source of origin.

Japan Post’s single-color mark

The second case involves Japan Post’s single-color mark. Japan Post also filed a trademark application on April 1, 2015, for a red color mark, which has long been used as their corporate color, for their letter services in Class 39. This application was rejected due to lack of distinctiveness in the examination stage, and a final decision of rejection was issued. Japan Post filed an appeal against the decision and submitted a consumer survey in an attempt to overturn the rejection. However, the survey was unsuccessful, and the registration was finally rejected.

The survey was conducted nationwide among 3,000 general consumers between the ages of 20 and 69. The respondents were shown a red-colored square shape and asked for the name of the company or organization they recalled from the color. As a result, 64.1% of the respondents answered the name “Japan Post”. However, the JPO Appeal and Trial Board found that this figure was not sufficiently high considering the fact that Japan Post has monopolized the postal service business for many years. In addition, 35.9% of the respondents answered the names of other companies, some of which were closely related to Japan Post's business field. Therefore, the JPO Appeal and Trial Board concluded that the results of the consumer survey did not necessarily indicate that the red color by itself was recognized as the source of the services provided by Japan Post.

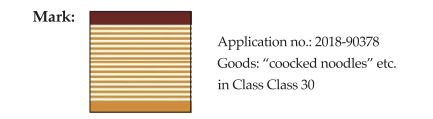

Nissin Foods’ combination color mark

The last case involves the color mark of Nissin Foods Holdings Co., Ltd. (“Nissin”). On July 12, 2018, Nissin filed an application for a color trademark for the orange border pattern used on the package of their “Chicken Ramen” products, designating the goods in Class 30 including "confectioneries, processed grain products, cooked noodles.” The JPO issued a Provisional Refusal stating that such applied-for mark merely indicated the characteristics of the goods in a commonly used manner and was lacking in distinctiveness. In response to this refusal, Nissin made an argument including that it has been using a striped pattern on a white background for its packaging since its initial sales in 1958, and has never changed the number of stripes (17 stripes), which is the basic configuration of the packaging. In addition, it pointed out that, as of the 45th anniversary of the launch, the cumulative sales had reached 4.5 billion servings, and the market share of “Chicken Ramen” with this trademark had remained stable at approximately 6-10% in the bagged instant noodle market from 1996 to 2018. Further, Nissin submitted the results of a consumer survey. As a result, the trademark managed to be registered during the JPO examination stage.

The survey was conducted among 3096 men and women in their 20s to 60s living throughout Japan. In one group, where respondents were asked about their vague recollection of the trademark by presenting the trademark with "instant noodles" as the goods, 87.23% of respondents correctly recalled the source of the trademark. In addition, even in the group, where respondents were asked about the source of the trademark without specifying the goods, 65.69% of respondents correctly recalled the source of the trademark, indicating a high degree of recognition. Based on the results of this survey, the JPO made a determination as early as the examination stage that the applied-for trademark had acquired distinctiveness.

Conclusion

As you can see from the results of the consumer surveys submitted in the above three cases, it is not necessarily true that a high level of number in questionnaires will be sufficient to constitute strong evidence, although it must also be said that the second unsuccessful case involved a single-color mark and the threshold for registration thereof is extremely high. Even if a high level of recognition is shown, there is still a possibility that the evidence may not be particularly persuasive if the range of consumers, geography, or purchasing experience is too limited. On the flip side, even if the resulting level of recognition is not extremely high, if the questionnaire results can be shown to prove the well-known nature of the mark throughout Japan, there is a good chance that it will be adopted as strong and compelling evidence. When submitting questionnaires as evidence, there is no set answer to the question of under what conditions and to what degree of recognition should be shown to prove that a mark is sufficiently well-known to be distinctive. In this sense, the design of the questionnaire is very difficult, and careful judgment is required as to whether the results obtained should be submitted as evidence. We will be keeping a close eye on future cases in this regard.

Member

PROFILE