ブログ

Series: Trends and Responses to Trump 2.0 – Part (5) Final Stage of Trump Tariffs and Corporate Legal Risk Management –

2025.08.08

This blog is an English translation of the original Japanese article available at the link below.

https://www.tmi.gr.jp/eyes/blog/2025/17337.html

Regarding the tariff measures recently implemented by the Trump administration, in accordance with a final agreement between the Japanese and U.S. governments on August 7, 2025, it was decided that a 15% reciprocal tariff (not as an additional tariff) would be imposed on Japanese goods imported into the US. It was also decided that a 25% additional tariff on automobiles and automobile parts would be revised down to 15% (not as an additional tariff), although the specific reduction would be made on a “timely” basis (Note). Regarding the tariffs imposed on semiconductors and pharmaceuticals, it was agreed that even if sector-specific tariffs were imposed, Japanese goods would not be treated less favorably than those of other countries. It has been stated that the details of the contents of the agreements between the governments will be announced in the near future.

(Note: According to the Executive Order dated July 31, 2025, it was decided that the reciprocal tariffs against Japan would be imposed as additional tariffs to be added to the existing tax rate. However, at the press conference held by the Japanese government, it was announced that the US government had acknowledged that the foregoing was incorrect and would be revised “in a timely manner”, and that the reduction of the tariffs on automobiles would be made at the same time as such revision. (press conference by Mr. Ryosei Akazawa, Minister in charge of Economic Revitalization of Japan in the morning of August 8, 2025)

Regarding legal risk management by Japanese companies against such tariff measures, it is necessary to assess the “impact” and the “possibility of occurrence” caused by the Trump tariffs, and to formulate the required countermeasures.

Individual companies are required to take strict measures by taking into consideration various factors such as products, distribution channels, licensing of related intellectual property rights, etc. In this article, we will explain the points that trigger this discussion.

Method of Analysis

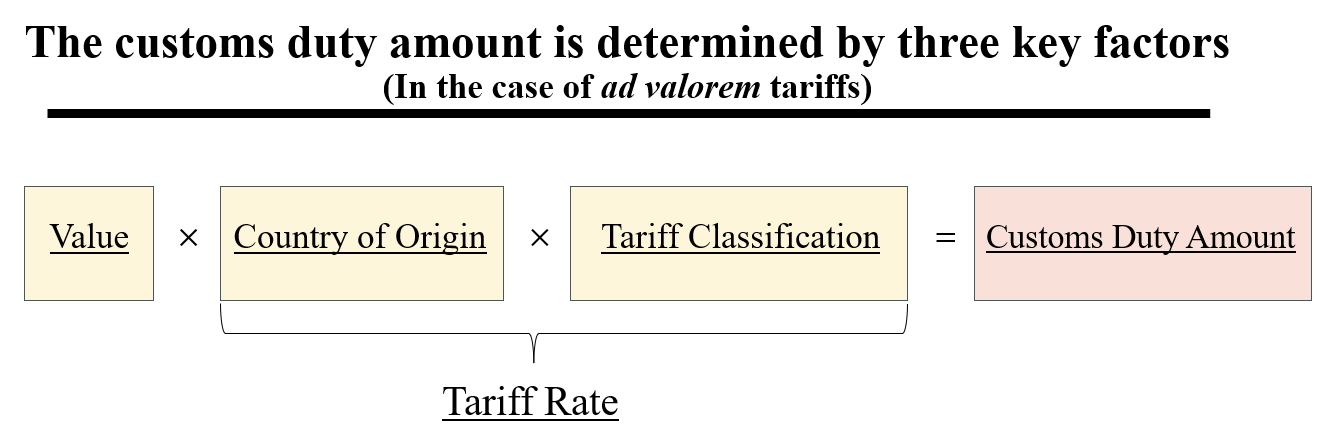

In conducting analysis, it is necessary to come back to the following three basic elements of tariffs.

The customs duty amount is determined by three key factors (In the case of ad valorem tariffs)

Keeping in mind the aforementioned three elements based on which the amounts of tariffs are determined, we will specifically explain as set forth below:

(1) Review and impact (risk) analysis of a company’s own products and supply chain

In order to discuss the impact of the Trump tariffs on a company’s own products and the countermeasures thereagainst, it is necessary to re-confirm the company’s supply chain and the relationship with the countries where the Trump tariffs are imposed. In particular, if a company handles many types of products, it may not be able to correctly grasp the supply chain for all of such products. Rather, the company may instead wish to conduct analysis on the level of impact by prioritizing its main products. The company can then confirm the HS code (the Harmonized Tariff Schedule of the United States (“HTSUS”) (Note 2) which is a tariff rates schedule applied to imports to the US) of the products that may be subject to the US tariff measures and the country of origin of its products that are the subject of the analysis, and map the target products will enable a specific assessment of the level of impact of the tariff measures on such company.

(2) Analysis on country of origin (Due diligence for country of origin)

Similar to point (1) above, in the first place, the tariff rates are determined by the country of origin of the relevant goods declared by an importer, and it is therefore necessary to conduct analysis of the country of origin of a company’s own products. Analysis of the country of origin as well as the HTSUS classification is required in order to conduct suitable scrutiny on the tariffs applicable to a company’s own products. In particular, analysis on the country of origin becomes even more important in cases where the products are exported to the US via (i) China, where volatile tariff rates have been seen amid the ongoing conflict between the US and China, (ii) Canada and/or Mexico, that require consideration of the USMCA (The United States - Mexico - Canada Agreement), or (iii) Southeast Asian countries, including Cambodia, Vietnam, and Thailand, for which high tariff rates have been imposed.

It is advisable to review the determination of the country of origin in view of the rules (Rules of Origin (Note 3)) that determine the applicable country of origin, or to change the country of origin or review the products or parts of suppliers by taking into consideration the relevant level of impact and economic security issues. As a result, re-construction of mid-to-long term supply chain may be required in some cases.

Note 2: HTSUS stands for the 10-digit code including additional digits specific to the US based on (an international) HS code (6 digits).

Note 3: Rules of origin are broadly divided into (i) Rules of origin including the Economic Partnership Agreement (EPA), (ii) Rules of origin for the Generalized System of Preferences, and (iii) Non-preferential rules of origin.

(i) Rules of origin including the Economic Partnership Agreement (EPA) mean the rules of origin determined by each EPA which are required to be satisfied in using the preferential tax rates in accordance with the EPA, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the Regional Comprehensive Economic Partnership Agreement (RCEP), and the United States-Mexico-Canada Agreement (USMCA);

(ii) Rules of origin for the Generalized System of Preferences mean the rules of origin under which it is determined whether the cargo imported from certain developing countries will be subject to the Generalized System of Preferences; and

(iii) Non-preferential rules of origin do not grant preferential treatment to specific countries; rather, in applying the WTO Agreement tax rates, such non-preferential rules of origin are formulated by each country in accordance with the WTO’s rules of origin.

(3) Review of customs value (Understanding of the customs value together with intellectual property rights)

In principle, the customs value should be calculated based on the actual transaction value (invoice value); however, it may be useful to re-examine the accuracy of the amount that should be included in the calculation of such value. In other words, there may be merit in considering whether the previous transaction values can be allocated among the product, the intellectual property rights and any services.

For example, (although this cannot be said for sure since the situation will differ depending on the case) supposing that there is a product attached with software that can be downloaded as an option by CD, USB, or the like, and the values of these are included in a lump sum in the transaction value. In such case, if a purchaser of the product can have the option of separately purchase by way of downloading depending on the needs of using the optional functions, the transaction value may be lower, thereby reducing the customs value. However, it is important to note that license fees related to imports need to be added to the transaction value despite the fees not having been stated in an invoice.

Accordingly, there will be cases where both the tariffs and the current status of the data and intellectual property rights need to be re-considered.

Method of Handling

Specific measures to manage high tariff rates

As a result of the foregoing items (1) and (2), if it is determined that the Trump tariffs will substantially impact a company’s own products (i.e., there is a high risk), it is important to consider the following measures.

<Supply chain re-examination>

- By making inventory adjustment and production schedule adjustment, import the target products into the US and keep the same before sector-specific additional tariffs (including additional tariffs imposed on pharmaceuticals and semi-conductors, etc.) are set to apply in the future.

- Re-design logistics and production routes that are less susceptible to tariff-related costs.

✓ By conducting substantial portions of the assembly processes in a country with lower tariff rates, such country will become the country of origin. (Note 4)

✓ Improve the composition ratio of the US origin raw materials and parts so as to enable the utilization of the “US content exclusion.” (Note 5)

However, please be advised that there are many cases where careful consideration is required in line with the actual situation to ensure that such measures are not deemed to be taken as an act of tax avoidance. (Note 6)

Note 4: Under the US non-preferential rules of origin, the country where a “substantial transformation” is finally made will be deemed the country of origin. Whether or not there is any “substantial transformation” largely depends on the facts of each case, making it important to conduct sufficient discussion and confirmation in advance.

Note 5: “US content” refers to the value of the goods attributable to parts that are wholly obtained, produced entirely, or substantially transformed in the United States. If more than 20% of the value of the products subject to the reciprocal tariffs is of US origin, the reciprocal tariffs are calculated based on the value that excludes the portion of US origin. See US Customs and Border Protection (the “CBP”) Guidance (#6468037).

Note 6: If the CBP finds the existence of a transshipment for the purpose of avoiding tariffs, an additional 40% tariff will be charged in lieu of the reciprocal tariffs, so it is important to pay special attention to this issue. See CBP Guidance (# 65829726), although the judgment criteria for finding the existence of a transshipment are not clearly stated.

<Utilization of existing tariff system>

- Utilization of Chapter 98 of the HTSUS (consideration for exemption): For example, considering the applicability to products for persons with disabilities (HTSUS 9817.00.96), etc., in accordance with the Nairobi Protocol

- Utilization of duty drawbacks (Tariff refunding system) (Note 7)

Note 7: A “duty drawback” is a mechanism that allows for the refunds of tariff-based duties, etc. paid for imported goods that are subsequently exported or destroyed. Duty drawbacks are not allowed for additional tariffs in accordance with the International Emergency Economic Powers Act (“IEEPA”), or for additional tariffs imposed on steel products, aluminum products, automobiles, and automobile parts; however, it has been made clear that duty drawbacks are allowed for reciprocal tariffs. See the CBP Guidance (#6468037).

<Countermeasures at corporate legal affairs>

- Contract review

✓ Insert provisions in agreements with business partners to enable price adjustments relating to the tariff burden.

✓ Insert provisions under which treatment equivalent to that utilized for “force majeure” events is taken upon the imposition of additional tariffs that cause an excessive burden.

<Lobbying governments or trade associations>

As there is a limit in taking countermeasures exclusively on the company’s own, continuously lobbying governments or trade associations should also be considered. In particular, it is considered to be important to have the voice of the US users be heard by the US government.

Conclusion

The outlook for the future development of the Trump tariffs remains uncertain. Under such unsettled circumstances, we consider it necessary to prepare for the suitable timing where things will turn around in the future by minimizing risk at this stage.

*Disclaimer: The information above is current as of August 8, 2025. The content of this blog is provided for general informational purposes only and does not constitute legal advice or a legal opinion. Please note that the content may not reflect the most current legal or regulatory developments. Readers should not act or rely on any information in this blog without consulting qualified legal counsel. Transmission of this information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. TMI Associates disclaims all liability for actions taken or not taken based on any content on this site.

TMI Associates

Attorneys

Kazuhide Ueno, Ryoko Kondo, Shinichiro Ishihara, Shinya Sakuragi, Yu Tomii, Leo Yamada

■Please also see our past blogs regarding Trump 2.0 countermeasures.

Series: Trends and Responses to Trump 2.0

Part (1) The Latest Developments in Reciprocal and Automotive Tariffs (February 21, 2025)

Part (2) Legal Basis for Tariff Imposition (March 18, 2025)

Part (3) Status and Dynamics of Reciprocal Tariffs under the Trump Administration (May 7, 2025)

Part (4) Content and Impact of International Trade Court Judgement Rendering Part of Tariffs Measures as Illegal (June 3, 2025)

■Introduction of TMI’s Customs and Duties Team and International Trade Practice Group

At TMI, our team includes attorneys who have experienced secondments at the Ministry of Foreign Affairs and the Ministry of Economy, Trade and Industry, as well as advisors formerly from the Ministry of Finance and other governmental agencies. These team members handle customs issues and other international trade matters.

International trade law, which is grounded in intergovernmental agreements such as World Trade Organization (“WTO”) agreements, the Fair Trade Agreement (“FTA”), and the Economic Partnership Agreement (“EPA”), etc., directly affects the activities of private enterprises. In recent years, regulatory actions by the competent authorities have intensified not only in the United States but also across Asia, South America, and other regions, further heightening risks for globally active companies.

Drawing on extensive experience across both domestic and international trade issues, TMI handles international trade matters both at the phase of using existing systems and of taking preventive measures.

(1) Cross-Border Practice

If our clients become involved in investigations into anti-dumping duties, countervailing duties, safeguard measures, or involved in investigations initiated by overseas authorities, or face other regulatory issues affecting trade or investment abroad, we leverage the resources of our own overseas offices as well as cooperation with foreign law firms to deliver the best advice possible. Where appropriate, we also support our clients in preparing and submitting opinions to the Japanese government in view of filing complaints against the WTO, thereby enabling our clients to raise challenges against foreign governments through the Japanese government.

(2) Domestic Practice

TMI also has extensive experience in the latest domestic practices, including advising the Japanese government in connection with international trade disputes, as well as conducting research on the application of Japanese trade laws and regulations. Our expertise further encompasses advising and representing domestic and international corporations, industry associations, and other entities, including providing filing application services for anti-dumping duties, countervailing duties, and safeguard measures on imports from foreign countries, as well as customs related services (tariff classifications, country-of-origin labeling, etc.). When necessary, our team works seamlessly with professionals across TMI in related areas such as antitrust and competition law, tax, and information and communications law to deliver integrated and comprehensive solutions.

For inquiries, please contact our team at: trade-customs(at)tmi.gr.jp (when entering the address, please replace “(at)” with “@”).